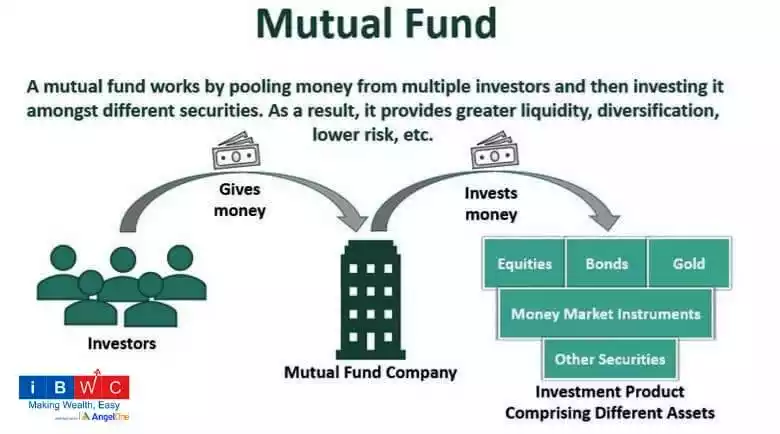

A mutual fund is a trust that collects money from investors sharing common investment objectives and then invests the money in securities such as stocks, bonds, assets and different money market instruments.

Why Must You Boost Your SIP Every Year ?

We know that SIP allows you the flexibility to select investment amount and tenure per your convenience. But many of us commit to it once and then forget to nurture it to grow even more.

SIP is a favoured way to invest in mutual funds, especially the salaried and middle-class who can afford only a fixed small amount. But there are instances when the salary grows, and then you can boost your SIP amount.

What does it mean by boosting SIP?

Boosting simply means increasing the amount of monthly contribution towards the mutual fund corpus.

SIP allows you to start investing with a minimum amount of Rs 500, but to accumulate a substantial amount of wealth in the long run, you must increase your contribution towards it. Suppose you were investing Rs 1000 for three years. But due to your performance, you get a hike of 25 percent. In this scenario, you can spend the excess amount. But more prudent would be to boost existing SIP by committing the extra amount to SIP.

There are significant benefits of stepping up your SIP amount. Here we have enumerated them below.

Boost growth in your corpus

SIP mutual funds work on the principle of compounding interest or compounding growth. It implies that return is calculated based on the previous principal amount and past accumulated interest.

So, when investors increase the principal amount, it boosts the interest income and the new principal. The result is a substantial rise in returns.

For example, an investment of Rs 10000 earns Rs 2,01,457 at the rate of 10 percent after ten years. Everything remaining the same, Rs 1200, will garner a return of Rs 2,41,748. So you can see that by increasing your investment by Rs 200 monthly, you can boost your returns substantially.

Protect yourself against inflation

Inflation is a situation of declining purchasing power of money. As time passes, the value of your savings gradually decreases. The best way to hedge against investment is to increase your investment.

Traditional savings plans do not offer a hedge against inflation. But by boosting your SIP, which grows at a compounding rate, you can create a cushion for your future expenses.

Reach your goal faster

The ultimate benefit of boosting the principal amount is that it helps you reach your financial goals faster. If you are investing with a plan to buy property, children’s education, or retirement, boosting your investment is the easiest way. Investors investing online have the option to increase their monthly contribution quickly, and with compounding, you can reach your planned goals faster than usual. By increasing the monthly SIP by Rs 200, you can receive Rs 10000 more in just three years.

How to boost your SIP

You can increase your contribution either by a fixed percentage or a fixed amount. However, you must set an upper limit so that the hike doesn’t exceed your budget. You can select a new scheme or top-up the existing one.

The best time to top-up SIP is during appraisal when your monthly income increases. You can increase your investment in the line of your income and expenses without troubling your current lifestyle. If you have received a bonus, you can temporarily park the additional corpus in a liquid fund and introduce a systematic transfer plan (STP) to transfer it to an equity fund.

However, you can increase your investment anytime. The objective is to achieve your financial goal faster, so avoid aligning the boosted SIP to a new purpose.

Remember that investing in any SIP plan alone won’t help in achieving your goal. Before selecting a scheme, do your research and choose the one that aligns with your goals and convenience. Flexibility is one of the several benefits of SIP. Hence, boost your SIP yearly to exploit the full potential of compounding.

Comments are closed